Calculating your hourly rate from your salary is an essential aspect of managing your finances, especially if you’re a freelancer, a part-time employee, or paid on an hourly basis. How to Calculate Hourly Rate from Salary? Knowing your hourly rate helps you to determine the value of your time and ensure that you’re being paid fairly. In this article, we will explain how to calculate hourly rates from salary step-by-step and provide tips on how to use this information to your advantage.

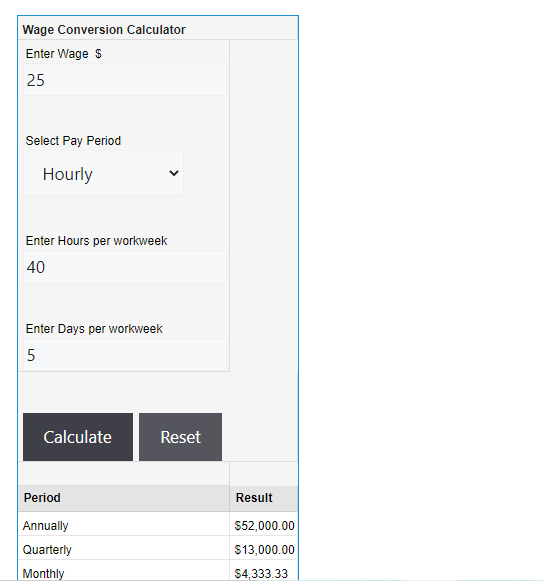

| Wage Conversion Calculator | ||

|

| ||

| ||

| Period | Result | |

|---|---|---|

| Annually | ||

| Quarterly | ||

| Monthly | ||

| Semi-Monthly | ||

| Bi-Weekly | ||

| Weekly | ||

| Daily | ||

| Hourly | ||

Use: Adp IPAY Hourly Calculator

How to Calculate Hourly Rate from Salary?

Step 1: Determine Your Salary

The first step in calculating your hourly rate is to determine your annual salary. If you’re a full-time employee, your salary is likely stated in your employment contract or offer letter. If you’re a freelancer, you may have negotiated a project-based rate, or you may have an hourly rate that you charge clients.

For the purposes of this article, we’ll assume that you have an annual salary of $50,000.

Step 2: Determine the Number of Hours You Work

The second step is to determine the number of hours you work each week. If you’re a full-time employee, you probably work 40 hours per week. However, if you work part-time or as a freelancer, you may work fewer hours.

For the purposes of this article, we’ll assume that you work 40 hours per week.

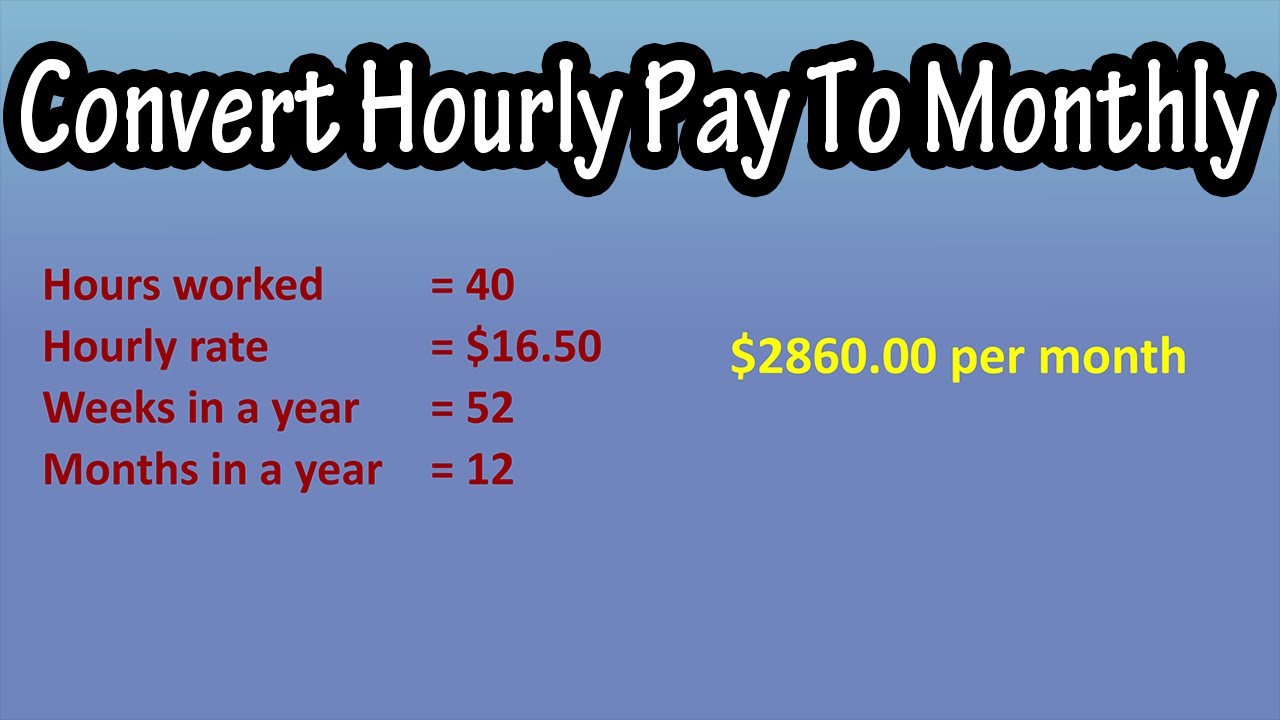

Step 3: Calculate Your Weekly Salary

To calculate your weekly salary, divide your annual salary by 52 (the number of weeks in a year). Using the example of a $50,000 annual salary, your weekly salary would be $961.54.

Step 4: Calculate Your Hourly Rate

To calculate your hourly rate, divide your weekly salary by the number of hours you work each week. Using the example of a weekly salary of $961.54 and 40 hours worked per week, your hourly rate would be $24.04.

Step 5: Adjust for Taxes and Other Deductions

It’s important to note that your hourly rate may not reflect your take-home pay after taxes and other deductions. To get a more accurate picture of your earnings, you’ll need to factor in deductions such as federal and state taxes, Social Security and Medicare contributions, and any other benefits or deductions.

To adjust for taxes and other deductions, you’ll need to know your effective tax rate. Your effective tax rate is the percentage of your income that you pay in taxes after all deductions and credits are taken into account. You can use an online tax calculator or consult with a tax professional to determine your effective tax rate.

Once you know your effective tax rate, you can adjust your hourly rate accordingly. For example, if your effective tax rate is 25%, you’ll need to multiply your hourly rate by 0.75 to get your after-tax hourly rate. Using the example above, your after-tax hourly rate would be $18.03 ($24.04 x 0.75).

Tips for Using Your Hourly Rate to Your Advantage

Knowing your hourly rate can help you make informed decisions about your career and finances. Here are some tips for using this information to your advantage:

- Negotiate your rate: If you’re a freelancer or consultant, knowing your hourly rate can help you negotiate higher rates with clients. Use your hourly rate as a baseline and be prepared to negotiate based on the complexity of the project and the value you bring to the table.

- Determine your value: Knowing your hourly rate can help you determine the value of your time and make informed decisions about which projects to take on. If a project pays less than your hourly rate, it may not be worth your time and effort.

- Set financial goals: Knowing your hourly rate can help you set financial goals and create a budget. Use your hourly rate to determine how much you need to earn each week or month to

- achieve your financial goals, and adjust your spending accordingly.

- Compare job offers: If you’re considering multiple job offers, knowing your hourly rate can help you compare the offers and determine which one is the most financially advantageous. Be sure to factor in benefits, vacation time, and other perks when making your decision.

- Plan for taxes: Knowing your hourly rate and effective tax rate can help you plan for taxes and avoid surprises when tax season rolls around. Consider setting aside a percentage of your income each month to cover your tax obligations.

- Monitor your income: Keep track of your income and expenses using a spreadsheet or budgeting app. This will help you stay on top of your finances and make adjustments as needed.

- Re-evaluate your rate: Your hourly rate may need to be adjusted over time as your skills and experience grow. Be sure to periodically re-evaluate your rate and adjust it as necessary.

- In conclusion, calculating your hourly rate from your salary is an important aspect of managing your finances. By following the steps outlined in this article and using the tips provided, you can determine the value of your time and make informed decisions about your career and finances. Remember to factor in taxes and other deductions, compare job offers, and set financial goals to ensure that you’re being paid fairly and achieving your financial objectives. With a little bit of planning and effort, you can take control of your finances and achieve financial success.

REF: https://www.capitalone.com/learn-grow/money-management/how-to-calculate-hourly-rate-from-salary/