When you try to manage the proper payment of your company, accurately tracking team members’ work hours is essential. You must choose a suitable timekeeping method and educate your team. Afterward, you may calculate hours worked and manage overtime by following these calculation steps.

Hence, your appropriate calculation for hours enhances productivity, wage accuracy, and teamwork. It’s a vital aspect of legal agreements in production companies. Thus, you should learn the worthy steps for calculation and effective overtime tracking. If you don’t want to read much, you can test out the Hourly paycheck calculator web tool to work fast.

Method: How to Calculate Hours Worked?

Once you want to know or explore the calculation market, you can find numerous methods and a wide array of software calculation options. These methods assist the employers in knowing the calculation process for employees’ work hours in managing their work.

However, the widely accepted approach for recording hours for payroll involves noting the start and end times. Subsequently, you can determine daily work hours and aggregate them for your upcoming payment period. We’ve introduced the most simple and effective guide to calculating the hours worked and employees’ payment.

Step #1: Establish Start and End Time Table

You can get a proper record of your team members’ beginning and closing times. However, you can apply this approach for your employee oversight or self-management.

Regarding this purpose, you can use our recording software to ensure accurate input of start and perfect ending times. You can also go for the Wrapbook. Remember, all software has its approaches (benefits & drawbacks). However, if any mistakes occur, you may correct them.

READ THIS: How to Calculate Hourly Rate from Salary?

Let’s note the start of the day is at 9:30 am ending at 6:45 pm.

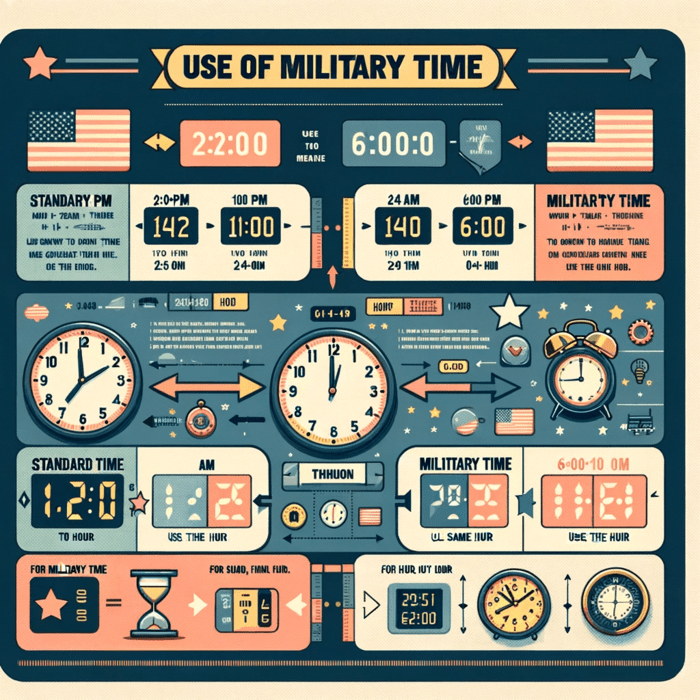

Step #2: Use Military Time Conversion

Once you calculate your time for work hours, the am/pm distinction often confuses time calculations. Avoid the confusion and simplify your daily hour calculation using military time. Military time operates within a 24-hour cycle, making your subtraction easier.

Therefore, the times before 1:00 p.m. stay unchanged, while from 1:00 p.m. onward, you must add 12 hours.

For instance, 8:15 am remains 8:15, and 3:35 pm becomes 15:35.

Beginning: 9:30 am = 9:30 hours

Ending Time: 6:45 pm = 18:45 hours

Step #3: Calculate your Time Difference

Although it’s a simple task, you subtract your start time from your end time to determine the hours worked.

Like;

18:45 – 9:30 = 9:15

Proves;

The whole work day will be 9 hours and 15 minutes in this scenario.

Step #4: Deduct Unpaid Breaks

When you prefer your hourly pay, consider factoring in break times. So, when calculating your schedule’s work hours or employee hours (such as a midday Netflix break), you must consider your break hours.

For instance, if you took a one-hour break;

9:15 – 1 = 8:15

Here, your hours are 8 hours and 15 minutes the following day.

When maintaining records, especially for employee tracking, unpaid breaks are often recorded by clocking in and out twice daily. These instances are then included in the schedule records. For instance, let’s say a break is taken from 1:00 p.m. to 2:00 p.m.

Although it’s pretty simple to note, you still have to stay accurate and trustworthy. It’s also a notable fact that regulations may vary across states.

Step #5: Decimal Format Conversion

After calculating your work hours, the next step is converting them to decimals. It exposes the precise multiplication with your whole hourly rate. So, for minutes to decimals conversion, you can divide your minutes by 60.

Like;

15 minutes / 60 = 0.25

Total: 8.25 hours

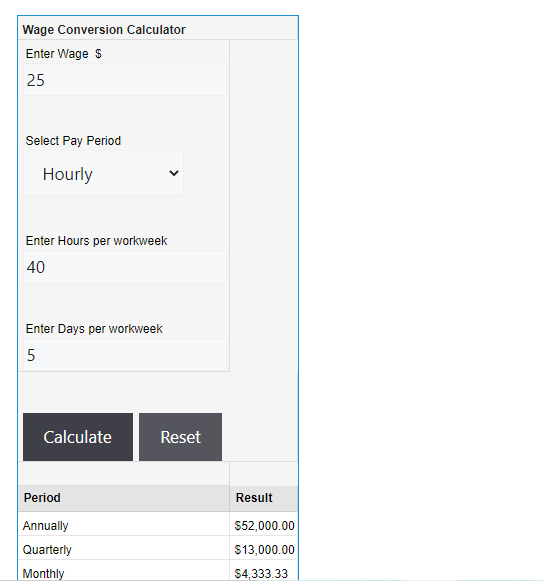

Step #6: Summing up Hours for Pay Duration

In roles with hourly compensation, your daily hours may fluctuate. This aspect makes it vital to evaluate the daily hour calculations. Once you determine the daily hours, these hours can be accumulated to establish your monthly, weekly, biweekly, or any applicable pay cycle hours. Hence, to calculate the wage for that pay period, multiply your total hours by your hourly rate. This ensures accurate compensation based on your worked hours.

For example, suppose you’re putting the 9.25 hours of work at a rate of $10 per hour, that’s paid every week. Its computation would appear as follows:

9.25 multiplied by $10 equals to $92.5

$92.5 multiplied by 7 equals $647.5

Your daily pay would amount to $92.5

According to this computation, your weekly earnings would total $647.5.

What’s the efficient way to track the work Hours?

Since you’ve calculated your hourly working and payments. You’ve monitored the day’s beginning and ending times, clock-ins & outs, overtimes, and breaks.

Furthermore, you must consider the best methods to Track Work Hours. Though you may go through the six appropriate ways to track hours:

Overtime Tracking

Overtime exceeds your regular hours, and it varies on account of country.

Under the FLSA, The overtime rate is 1.5 times the US’s standard 40 hours/week. Companies are even permitted to offer more than this specified amount. Here’s the calculation:

Overtime Salary = Hourly pay rate x overtime rate

In other words, Overtime rate = 1.5 x hourly pay rate (beyond 40 hrs/week).

For example, suppose the hourly wage is $12, and the overtime rate is $18 (multiplied by 1.5).

If you work 45 hours/week at $12/hour, 5 hours are overtime. So, you can compute your salary by using the standard rate for the initial 40 hours and then add the overtime pay:

Calculate: ($12 x 40) + ($18 x 5) = $480 + $90 = $570

You receive $570/week.

As per the FLSA, all companies must provide overtime compensation to part-time workers (exceeding 40 hours/week).

Final Verdict

Calculating your hours worked is essential for accurate pay and productivity tracking. To calculate it, you need to note the start and end times, subtract breaks, and sum the hours for the pay period. You are proficient in utilizing the time-tracking software that can simplify this process.